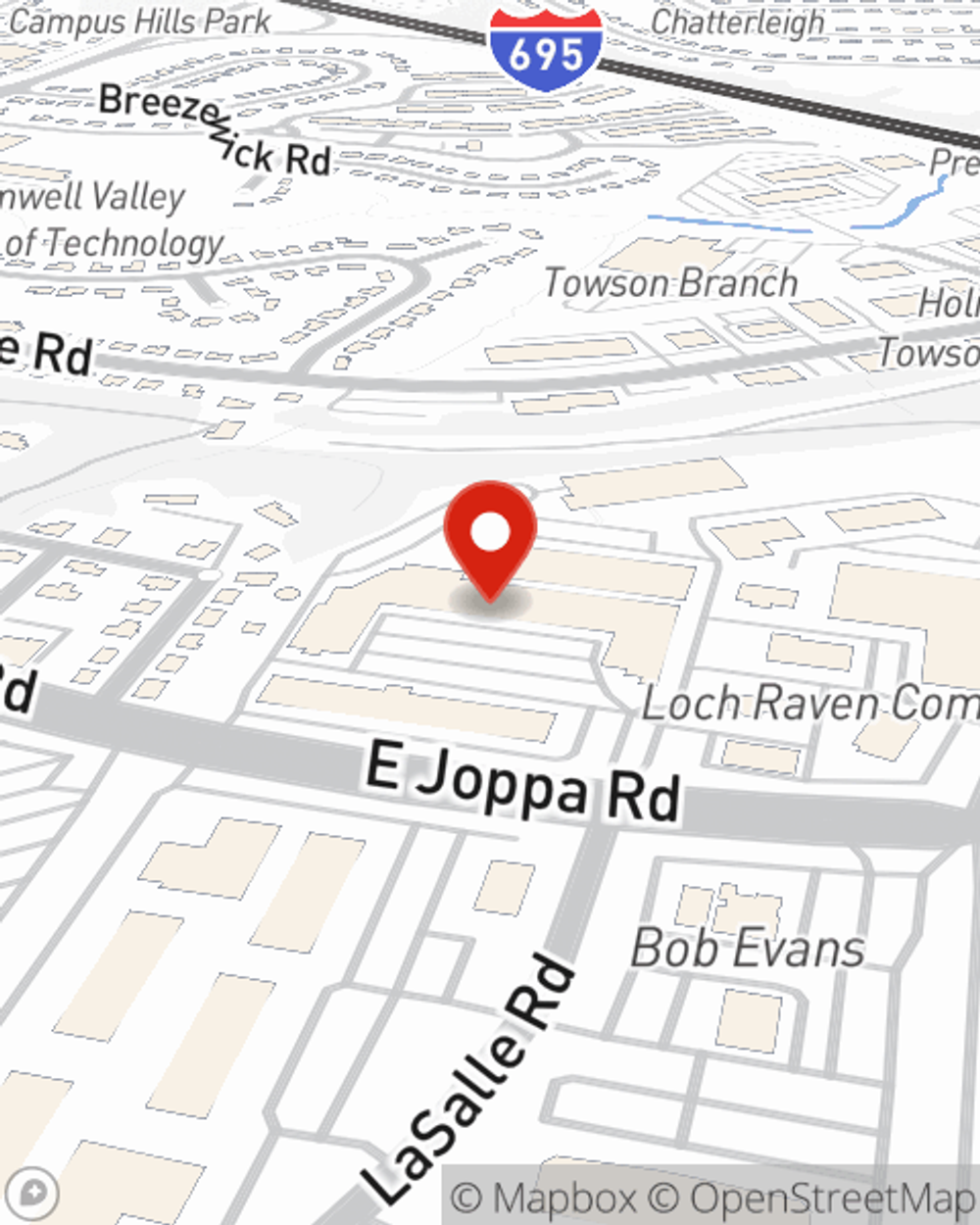

Renters Insurance in and around Towson

Towson renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Towson

- Baltimore County

- Hereford

- Timonium

- Cockeysville

- Lutherville

- Hunt Valley

- Sparks

- Monkton

- Parkville

- Carney

Protecting What You Own In Your Rental Home

Home is home even if you are leasing it. And whether it's an apartment or a condo, protection for your personal belongings is a good precaution, especially if you own items that would be difficult to fix or replace.

Towson renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Why Renters In Towson Choose State Farm

Renters often underestimate the cost of refurnishing a damaged property. Just because you are renting a apartment or townhome, you still own plenty of property and personal items—such as a microwave, cooking set, set of golf clubs, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why purchase your renters insurance from Margie Parker? You need an agent who is dedicated to helping you evaluate your risks and understand your coverage options. With competence and wisdom, Margie Parker is here to help you protect yourself from the unexpected.

Don’t let fears about protecting your personal belongings stress you out! Call or email State Farm Agent Margie Parker today, and explore how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Margie at (410) 337-8400 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Margie Parker

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.